by Oasis Accountants | Jun 2, 2023 | Newsletter

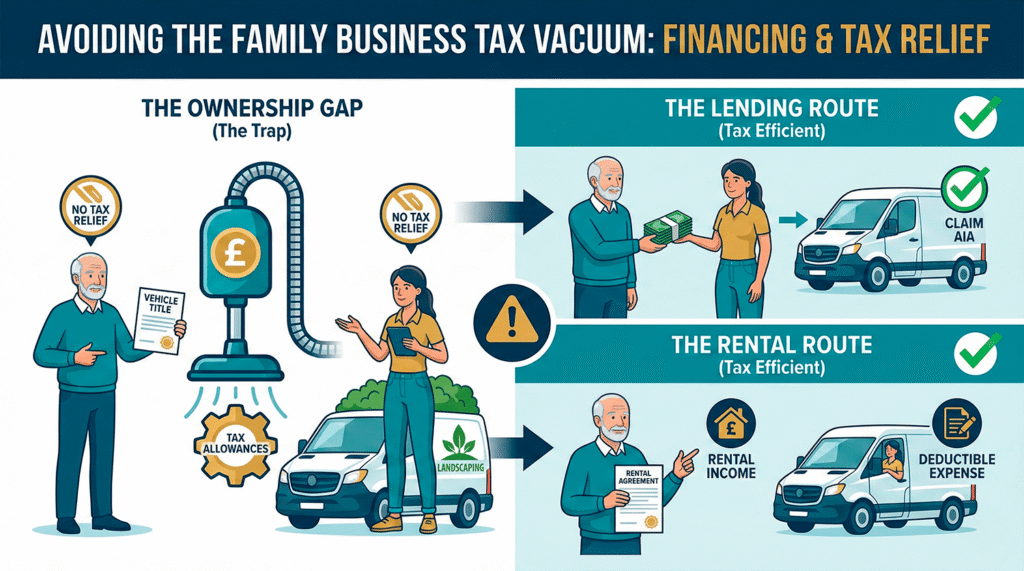

Owner-managers can extract funds from the company in various ways. Typically, the working shareholders may well, in addition to drawing a normal salary, decide whether to extract surplus profits by means of a bonus or dividend. Hitherto, the high levels of National...

by Oasis Accountants | Jun 2, 2023 | events

Hounslow Business Awards 2020-21 > Resources > Events Published On June 2, 2023 Hounslow Business Awards 2020-21 > Resources > Events Published On June 2, 2023 Recent Posts 5 signs you’ve outgrown your DIY accounting solutions February 14, 2024 Buying...

by Oasis Accountants | Jun 2, 2023 | events

Biba Mega Durga Puja 2021 > Resources > Events Published On June 2, 2023 Biba Mega Durga Puja 2021 > Resources > Events Published On June 2, 2023 Recent Posts 5 signs you’ve outgrown your DIY accounting solutions February 14, 2024 Buying property through a...

by Oasis Accountants | Jun 2, 2023 | events

Hounslow Festival of Business 2022 > Resources > Events Published On June 2, 2023 Hounslow Festival of Business 2022 > Resources > Events Published On June 2, 2023 Recent Posts 5 signs you’ve outgrown your DIY accounting solutions February 14, 2024 Buying...

by Oasis Accountants | May 26, 2023 | Newsletter

The current late payment and repayment interest rates applied to the main taxes and duties that HMRC currently charges and pays interest on are Late payment interest rate — 7% from 31 May 2023 Repayment interest rate — 3.5% from 31 May 2023 HMRC interest rates are...