by Oasis Accountants | Jan 2, 2026 | Newsletter, Uncategorized

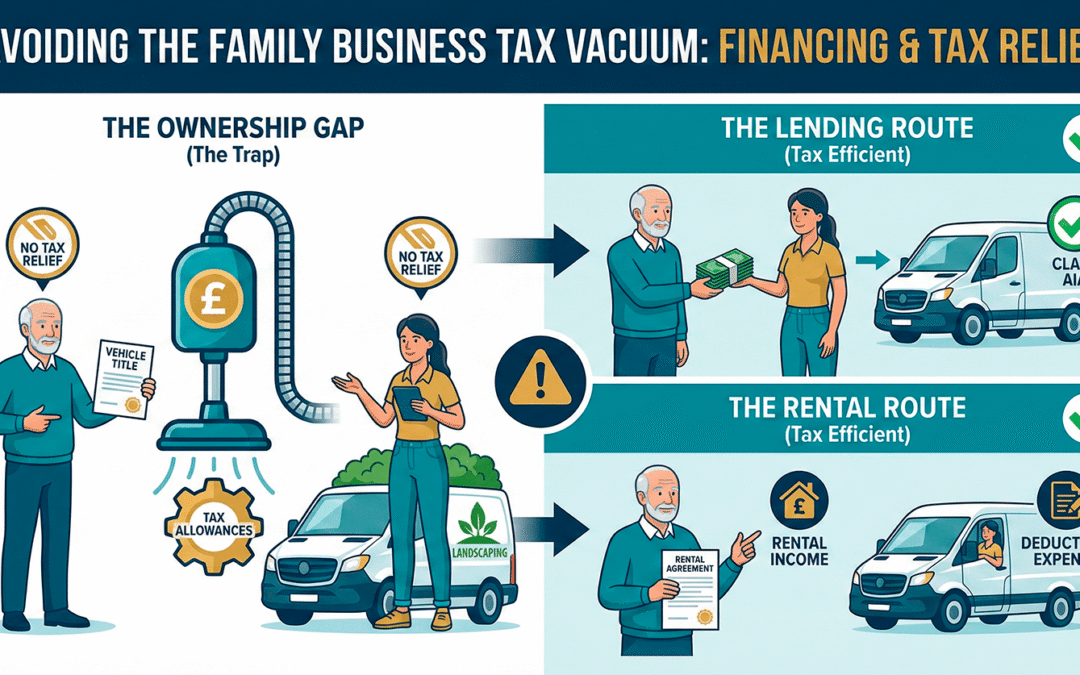

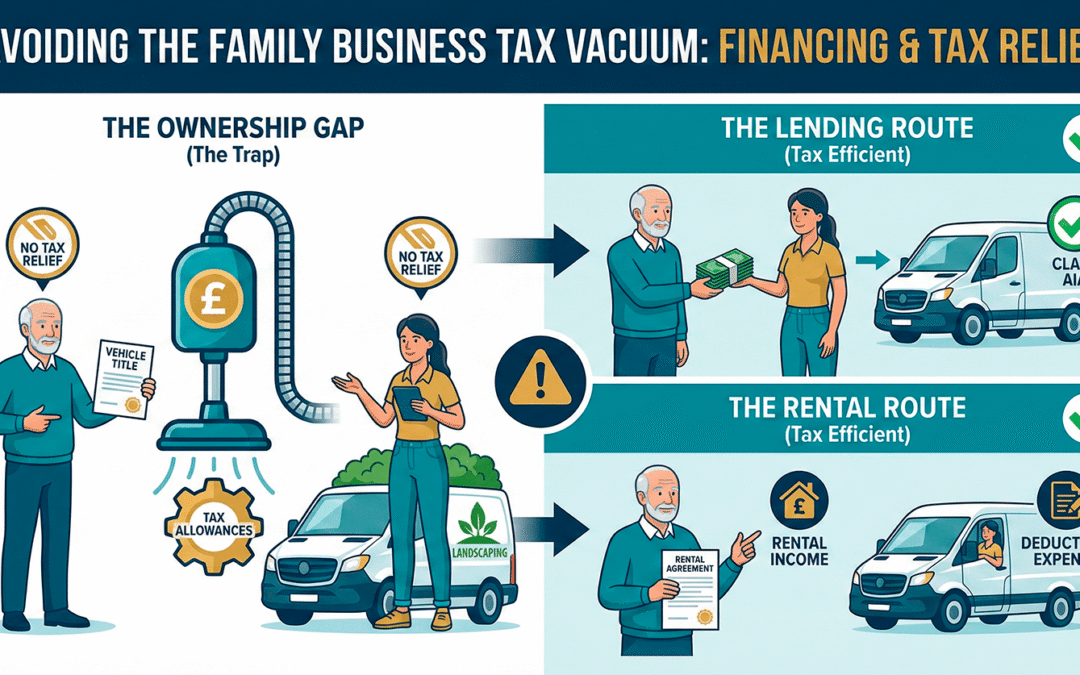

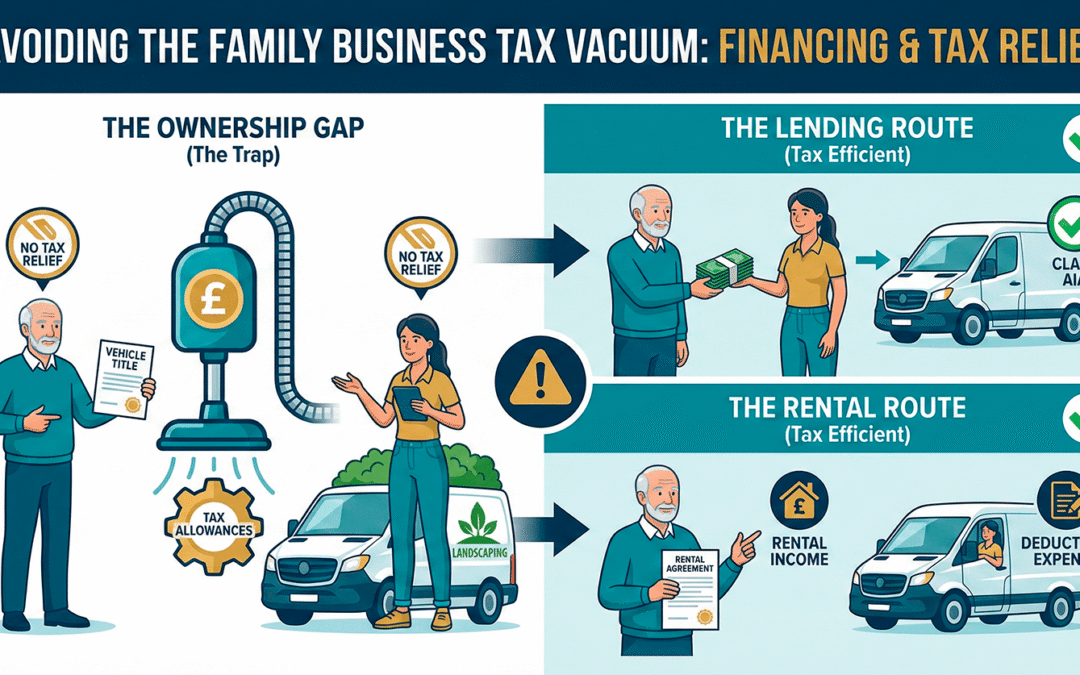

It is a common story: a family member wants to help a young entrepreneur get their business off the ground by financing a major purchase—like a van or specialized equipment. However, as one recent case illustrates, good intentions without proper tax planning can lead...

by Oasis Accountants | Dec 26, 2025 | Newsletter

For many years, salary sacrifice has been one of the most tax-efficient ways to build a pension. However, following the latest Budget, a significant shift is on the horizon. From 6 April 2029, the National Insurance (NI) advantages of these arrangements will be...

by Oasis Accountants | Dec 19, 2025 | Newsletter

Succession planning is a cornerstone of long-term business strategy, and Gift Holdover Relief is often the engine that makes it possible. Following the recent Budget, the government has announced a “modernisation” of this relief set for 2026. While the...

by Oasis Accountants | Dec 12, 2025 | Newsletter

Business Asset Disposal Relief (BADR) remains one of the most valuable capital gains tax (CGT) reliefs available to individual business owners. It offers a reduced CGT rate of 14% for 2025/26 on qualifying gains, subject to a £1 million lifetime limit. However, note...

by Oasis Accountants | Oct 28, 2025 | Blogs

Running a business in the UK is rewarding, but it also comes with financial responsibilities that can be challenging to navigate. Taxes, in particular, are a critical area where businesses can easily overspend if they aren’t managed correctly. Engaging professional...