by Oasis Accountants | Jun 2, 2023 | events

Hounslow Festival of Business 2022 > Resources > Events Published On June 2, 2023 Hounslow Festival of Business 2022 > Resources > Events Published On June 2, 2023 Recent Posts 5 signs you’ve outgrown your DIY accounting solutions February 14, 2024 Buying...

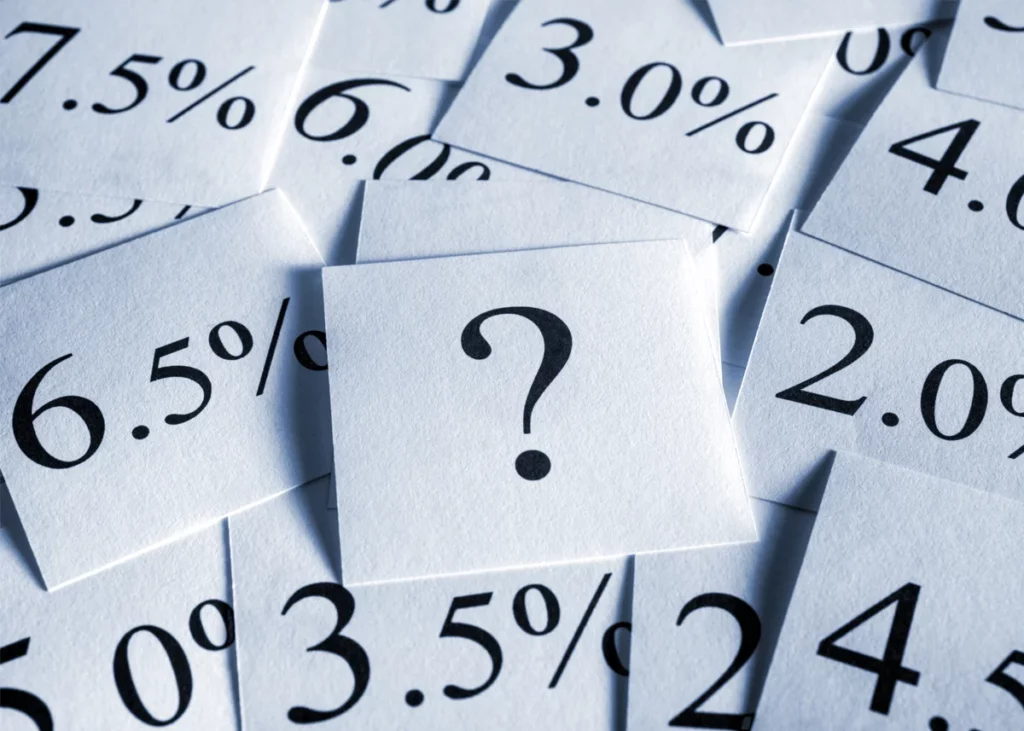

by Oasis Accountants | May 26, 2023 | Newsletter

The current late payment and repayment interest rates applied to the main taxes and duties that HMRC currently charges and pays interest on are Late payment interest rate — 7% from 31 May 2023 Repayment interest rate — 3.5% from 31 May 2023 HMRC interest rates are...

by Oasis Accountants | May 19, 2023 | Newsletter

HMRC is raising awareness of the tax treatment of termination payments related to Income Tax and National Insurance Contributions (NIC) Several changes have been made to these rules over the past five years, which HMRC wants to remind accountants and employers to...

by Oasis Accountants | May 12, 2023 | Newsletter

It’s important to know if you’re a UK resident or not. This may affect: Your UK tax liability Your entitlement to Income Tax allowances and exemptions UK Residence – Tax Liability When you’re UK resident you’re normally taxed on the arising basis of taxation. This...

by Oasis Accountants | May 5, 2023 | Newsletter

The Apprenticeship Levy was first announced in the Summer Budget 2015 and it was later confirmed in the Autumn Statement 2015 that the levy would be introduced from 6 April 2017. Primary legislation was subsequently included in the Finance Act 2016, Pt. 6 (s. 98...

by Oasis Accountants | Apr 28, 2023 | Newsletter

When Travel & Subsistence Qualifies For Tax Relief The term ‘travel expenses’ includes the actual costs of travel together with any subsistence expenditure and other associated costs that are incurred in making the journey. Travel In The Performance Of The...