Changes in Taxes from April 2024

> Resources

>

Newsletter

> Resources

>

Newsletter

Changes to the High Income Child Benefit Charge

The government announced the changes to the High Income Child Benefit Charge, and an increase to the threshold to £60,000 from 6 April 2024, with a taper up to £80,000. The charge will be 1% of the Child Benefit for every £200 of income that exceeds £60,000 and will equal the payment for income that exceeds £80,000.

You may be interested in claiming Child Benefit or restarting Child Benefit payments if you have previously opted out. The charge is tapered, so if you, or your partner, earns between £60,000 and £80,000 it can still be worth their while financially to claim.

If you have not yet claimed Child Benefit

If you have not yet claimed Child Benefit you can claim in the HMRC app or online. Child Benefit is automatically backdated for 3 months, or to the date of birth of the child if later.

New Child Benefit claims made on or after 6 April 2024 and before 8 July 2024 will result in payments being backdated but will be subject to the charge in the 2024 to 2025 tax year, if your income exceeds the new threshold of £60,000.

For instance, if you make a new claim on 6 May 2024, your Child Benefit payment will be backdated to 6 February 2024, but you will only pay the charge in the 2024 to 2025 tax year if your income exceeds £60,000.

You or your partner will need to file and pay any 2024 to 2025 charge via Self-Assessment by 31 January 2026.

2024 National Insurance contributions rate changes from 6 April 2024

A cut to the main rate of Class 1 employee National Insurance contributions from 10% to 8% from 6 April 2024.

The main rate of Class 4 National Insurance contributions for the self-employed will now be reduced from 9% to 6%.

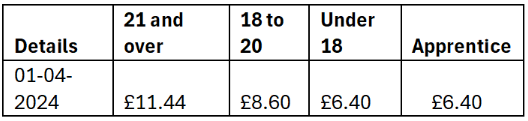

National Minimum Wage

The National Living Wage (NLW) and National Minimum Wage (NMW) are the lowest rate of pay per hour that most workers must be paid by law. It does not matter how many workers you employ, you must pay the correct minimum wage.

From 1 April 2024, workers aged 21 and over will be entitled to the National Living Wage.

Student and postgraduate loans

Student loan plan type and postgraduate loan thresholds and rates from 6 April 2024 are as follows:

- Plan 1: £24,990

- Plan 2: £27,295

- Plan 4: £31,395

- Postgraduate loan: £21,000

Deductions for:

Plan type 1, 2 and 4 remain at 9% for any earnings above the respective thresholds postgraduate loan remains at 6% for any earnings above the respective threshold.