Understand Your Corporation Tax Rate

> Resources

>

Newsletter

> Resources

>

Newsletter

From 1 April 2023, the main rate of corporation tax increases to 25%, but companies with sufficiently small profits will continue to pay only 19%.

Under the new rules

- The small profits rate of 19 % will apply if a company’s relevant profits (referred to as its ‘augmented profits’) are below £50,000,

- The main rate of 25 % will apply if those profits are over £250,000, and

- ‘Marginal relief’ will be available to give an intermediate overall effective rate if the profits are between these limits i.e., (£50,001 to £250,000).

Where a company has a number of ‘associated companies’, the relevant thresholds for applying the main rate are reduced, effectively splitting the potential benefit between them.

Associated companies

Two companies are associated companies if:

- – One company controls the other(s), or

- – Both are controlled by the same ‘person’ (company or individual).

Control

Control means that the person has > 50% of

- – the issued share capital of another company, or

- – the voting power, or

- – the right to receive distributable profits, or

- – the right to receive the net assets in the event of a winding up.

Examples of each situation:

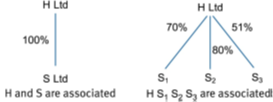

1. One company controls the other(s).

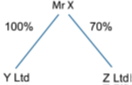

2. Both are controlled by the same ‘person’ (company or individual).

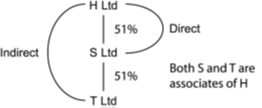

Note that control can be exercised directly or indirectly.

It is not necessary to have an effective interest of > 50% for associates.

Therefore, it does not matter that H Ltd.’s effective interest in T Ltd is only 26.01%

(0.51 × 0.51).

The definition of associated companies specifically includes:

- – overseas resident companies

- – subsidiaries joining and leaving during the AP.

but excludes:

- – dormant companies, and

- – inactive non-trading holding companies.

The consequences of associated companies

- The upper and lower limits used to determine the appropriate rate of corporation tax to apply, are divided by the total number of associated companies during the accounting period (i.e. including any which were not associated for the whole of the accounting period), thereby potentially increasing the effective rate of tax each company pays.

- The £1.5 million threshold used to determine whether the company is ‘large’ for the purposes of paying corporation tax quarterly instalments is divided by the total number of associated companies at the end of the previous AP.

- Dividends received from associated companies(UK and overseas) are excluded from the calculation of augmented profits.

- A group of companies is entitled to a single annual investment allowance (AIA) for capital allowances but can choose how to allocate the AIA between group companies